21 Water Heater Qualified Improvement Property

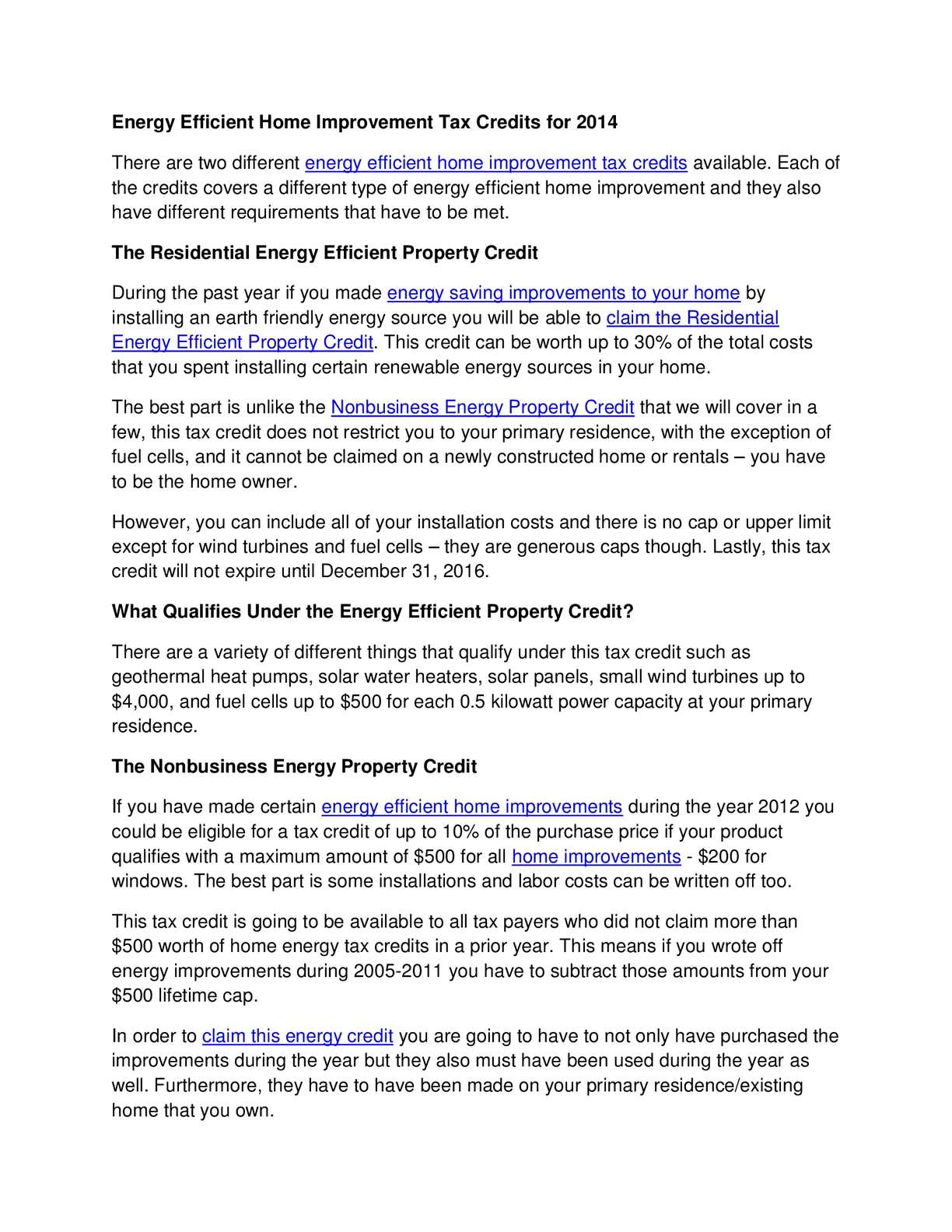

Property eligible for bonus depreciation has historically been limited to machinery equipment and software. Water heaters natural gas propane or oil biomass stoves. The residential energy property credit which expired at the end of december 2014 was extended for two years through december 2016 by the protecting americans from tax hikes act of 2015.

water heater qualified improvement property

Water Heater Qualified Improvement Property

Please note that qualifying property must meet the applicable standards in the law. However with the passage of the path act and beginning after december 31 2015 the definition of property that is eligible for bonus depreciation is expanded to include qualified improvement property qualified improvement. Qualified solar water heating property costs are costs for property to heat water for use in your home located in the united states if at least half of the energy used by the solar water heating property for such purpose is derived from the sun.Qualified improvement property qip is defined as any improvement to an interior portion of a building that is nonresidential real property as long as that improvement is placed in service after the building was first placed in service by any taxpayer section 168k3. Water heaters non solar are a part of residential energy property costs. Qualified improvement property a category that came out of the 2015 path act now replaces the prior categories of qualified leasehold improvements qualified retail improvement property and qualified restaurant property.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration. The qip provisions are effective for property placed in service after. Details of the nonbusiness energy property credit extended through december 31 2019 you can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

Non Renewable Resources Pros And Cons

Https Kingcounty Gov Media Depts Dnrp Solid Waste Green Building Documents Energy Efficiency Residential Ashx La En

25c Federal Tax Credit On Air Conditioners Cooling Fx

Centon Electric Instant Water Heater Geyser For Shower Gd600ep

Itf Ipp Ch06 2012 Final

Us Craftmaster Water Heaters Manualzz

Best Tankless Water Heaters Reviewed In 2020

Are Plumbing Permits Required For Water Heater Repair

Solar Heating Systems Solar Hot Water Heaters Guide

The Landlord S Hot Water Heater Buying Guide Accidental Rental

Home Performance Rebates And Loans Columbia Power Partners

America S Professional Tax Service Home Facebook

Rinnai Ru130in Sensei Super High Efficiency Tankless Water Heater

2019 Furnace Air Conditioner Government Rebates Furnaceprices Ca

Pt Model Operation And Maintenance Manual

Pdf Integrated Collector Storage Solar Water Heaters Survey And

Federal Tax Credit For Rinnai America Corporation Customers Oil

Rebates

Calameo Federal Energy Tax Credits 2013 2014

California Pace Eligible Improvements Ygrene

Https Www First5kern Org Wp Content Uploads 2018 07 Pge Energy Savings Assistance English Pdf

Water heater qualified improvement property. Qualified solar water heating property costs. Exclusions include house enlargements the addition of elevators and escalators and. According to energy star water heaters account for 12 of the..

Qualified leasehold improvements and qualified improvement property are deductible over 15 years instead with an option for bonus depreciation the first year. Qualified energy efficiency improvements and residential energy. Qualified real property qualified improvement property under irc sec. Water heater qualified improvement property.

Image Source: Google Images